Other factors would include care for minors or Animals and any charitable trusts or donations anyone would want to incorporate. Everyone with property or goods of any size need to examine estate preservation and planning irrespective of just how much (or minimal) you'll have.

As a result of these modern-day platforms, you don’t want many hundreds of Countless bucks but can begin with a little quantity and spend money on assets like real estate property, copyright, and farmland within an IRA.

Advertiser Disclosure We've been an impartial, promoting-supported comparison provider. Our target is to help you make smarter fiscal decisions by furnishing you with interactive resources and financial calculators, publishing original and aim content, by enabling you to definitely carry out investigate and Review details free of charge - so that you can make financial choices with self-confidence.

When you contribute funds to a standard IRA, you commit the money from the stock current market and get pleasure from prolonged-term investment progress. Moreover, an IRA permits you to defer earnings taxes on your contributions and spend them after you withdraw income in retirement.

Pretend custodians and investment choices are just two techniques you can hazard your retirement savings with an SDIRA. As well as Securities and Exchange Fee (SEC) notes that it’s completely achievable to get a fraudster to try to market you a pretend investment by a perfectly sound custodian.

In the event you’re searching for a minimal-Expense leader during the self-directed IRA House, RocketDollar has you lined. You’ll gain entry to the many alternative investment alternatives you’d hope from an SDIRA custodian and additional capabilities like “deliver your own personal offer” (BYOD), which helps you to skip the custodian offer review procedure.

Creating this option will depend on your needs and private circumstances. Many of us may be able to establish this by themselves, based on an evaluation in their finances, present tax problem, and upcoming requirements.

Be in control of how you mature your retirement portfolio by using your specialised expertise and passions to invest in assets that healthy with the values. Obtained abilities in property or personal fairness? Utilize it to assist your retirement planning.

These cash is often held in conventional IRAs, which are offered by means of most brokers for no annual rate, no transaction expenses and minimal fund fees.

Alto IRA launched in 2018 having a concentrate on streamlining the whole process of buying alternative assets effortlessly by partnering with outdoors investment platforms. Most important Characteristics:

We do not present monetary assistance, advisory or brokerage services, nor can we propose or advise people or to order or offer particular shares or securities. Performance information could possibly have changed Because the time of publication. Previous performance is not indicative of future results.

We use knowledge-pushed methodologies To guage financial solutions and companies, so all are measured Similarly. You can study more details on our editorial tips and also the investing methodology for that scores below.

Purchaser Help: Look for a company that provides dedicated assist, like access to experienced specialists who will reply questions on compliance and IRS guidelines.

There are several approaches to fund your new IRA, while this may vary a little bit based on the broker you end up picking. The most typical and easy approach is linking your lender account directly click to find out more to your IRA.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Andrew Keegan Then & Now!

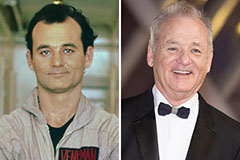

Andrew Keegan Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!